Crypto, NFTs, blockchain, and Web3 are all words that get thrown about a lot and seemingly rarely in level-headed discussions online.

There seems to be one side that thinks cryptocurrency is the future and that it will revolutionize the world's entire financial system whereas others think the whole thing is a fad that's never going to expand beyond the minority of people using it today.

While the internet is rarely a good place for nuance, we're going to try and look at the future of cryptocurrency and see how the most likely outcome is probably somewhere in the middle.

But first, let's see what cryptocurrency is, how it all works, and what blockchain technology is before trying to work out what the future looks like for it.

What Is Cryptocurrency and How Does It Work?

Firstly, cryptocurrency is a digital currency. Traditional currency has a physical version in the form of bills and coins and is generally controlled by the government issuing it. Cryptocurrency, on the other hand, is fully digital and doesn't really exist in the physical world.

The way cryptocurrency is spent is fairly similar to how a lot of us spend our money anyway since paying by card or online shopping rarely sees physical cash change hands. In these kinds of transactions, banks and payment service providers will confirm the transaction, remove the amount you're paying from your account and add it to the account of the vendor, store, or person that you're paying.

It's probably very likely that you haven't seen all your money in a physical form and that it's more common for your account balance to be digital. What happens here is that the accounts of everybody involved are changed to reflect the transaction and once confirmed, everyone can go on with their lives or onto the next transaction.

Cryptocurrency is a little different because it uses blockchain technology to confirm these transactions.

The Blockchain

The simplest explanation of a blockchain is that it's a ledger; a record of transactions made. However, rather than being kept at your bank, a copy of it is distributed to everybody and it's publicly available.

We have to be clear here that there's no information here that can identify you so while the transactions are visible, you'll still remain anonymous and blockchain technology uses secure cryptography to keep the network safe from hackers.

When a transaction is made, a “block” is created that details the transaction. Rather than this overriding or erasing the previous data (like balances, etc.), this block of data is merely added to the end of the “chain”.

The blockchain is the sum of all the transactions made by everybody, in order, and accessible by everybody. This means that you can't just change the ledger to say what you want because you'd need to change everybody's copy at the same time, which given the cryptography involved (hence “crypto” or “cryptocurrency), makes it almost impossible.

Types of Mining and Validation

To validate the transactions, there needs to be consensus among the users that the ledger is correct and that any changes are confirmed by everyone, rather than a single entity like a bank or financial institution.

The validation process is called "mining" because cryptocurrencies, such as Bitcoin and Ether, are finite so there's a limit to how much of it can be created or "mined".

Each network uses different types of validation and which one is best remains open to debate, but the two most common types are proof of work and proof of stake.

Proof of Work

Proof of work is a way to verify transactions and add them to the blockchain. Every time a block is to be added, people (or more importantly their computers) are given a difficult mathematical problem to solve that will take some time and a lot of computing power.

Basically, the answer to this mathematical problem serves as the password and computers have to randomly guess at answers until they get it. By getting the answer, that computer has proven that it's done the work and is subsequently rewarded with some cryptocurrency and then goes on to validate the transaction.

Proof of work has some problems because the work is designed to be time-consuming and hardware-intensive, which means a lot of energy is used, which is why mining is often said to be harmful to the environment. This type of mining is used by Bitcoin.

Proof of Stake

Another option for validating blockchain transactions is called proof-of-stake. Unlike proof-of-work, proof-of-stake doesn't have multiple participants wasting time and energy for just one computer to validate and ultimately win the crypto.

In proof-of-stake, the work still has to be done, but rather than have multiple people competing to do the work, the task of validating is awarded to someone (their computer) because they staked some coins to be picked.

Proof-of-stake also penalizes those who attempt fraud or fail to complete the work by "slashing" or taking a portion of their stakes from them.

Famously, the second-largest cryptocurrency (after Bitcoin) Ether on the Ethereum blockchain shifted its network from proof-of-work to proof-of-stake mining, greatly reducing its environmental impact.

Cryptocurrencies

For blockchain networks, there are accompanying tokens or currencies attached, known as cryptocurrencies.

Basically, cryptocurrencies work exactly the same as currencies for users as they can be traded and used in the exchange of goods and services where they're accepted and that's the biggest issue surrounding cryptocurrency; its validity in our society.

The main advantage for many users is the fact that cryptocurrencies are far more secure than traditional currencies as fraudulent transactions are almost impossible.

There are advantages to cryptocurrencies that are undeniable and it's very appealing to many to have financial systems away from banks or governments, especially in certain parts of the world.

Is Crypto Real Money?

Legally speaking, cryptocurrency isn't classed as real money by the federal reserve or by US banks. However, there are talks of changing the status of Bitcoin to a “legitimate asset class”, effectively recognizing it as real money.

It's not really as black and white as “real” money. A currency is only as valuable as the trust in the currency itself.

After all, we just use currency to facilitate trade and anything that does that is basically a currency. Rather than having a bartering economy where everything's traded for everything else, having something that can be traded for any kind of goods or service is useful provided that everyone agrees or recognizes it.

In a casino, for example, the chips represent the value of real money, but these chips are fairly useless outside of the casino. Within the casino, these chips have value because everybody accepts them and they can be used there in the casino. These chips are essentially worthless outside said casino, especially if you can't get to the casino, but for somebody inside the casino, they're fully worth their value on them.

Each cryptocurrency is the same. Their value is basically the sum of the confidence in the cryptocurrency and the greater a cryptocurrency's utility and value, the more legitimate it is as a currency.

If Bitcoin was accepted in every store around the world, then it would be arguably far more “real” than the dollar, for example.

Will Crypto Survive?

There's little doubt that crypto won't survive. Even as the volatility remains, there's such a strong belief among those already invested in cryptocurrencies that it is the future of money that it'll never fully disappear.

However, the uncertainty in the crypto sector does spell bad news for certain firms, currencies, and blockchains, especially if there's regulation coming.

A lot of experts are suggesting a bumpy ride for the entire sector, but blockchain technology has so many advantages that it's hard to see it disappearing so naturally the best-performing cryptocurrencies will also likely survive.

Whenever there's a lot of buzz surrounding any sector, we'll likely see a lot of movement, with new actors popping up and disappearing before stabilizing.

With regulation, we'll be likely to see more risk-averse investors move into cryptocurrency and blockchain-based technologies and applications.

Discover the transformative potential of cryptocurrencies and blockchain technology through immersive crypto courses, equipping yourself with the knowledge and skills needed to navigate this dynamic digital landscape with confidence and foresight.

Is Crypto Really the Future of Money?

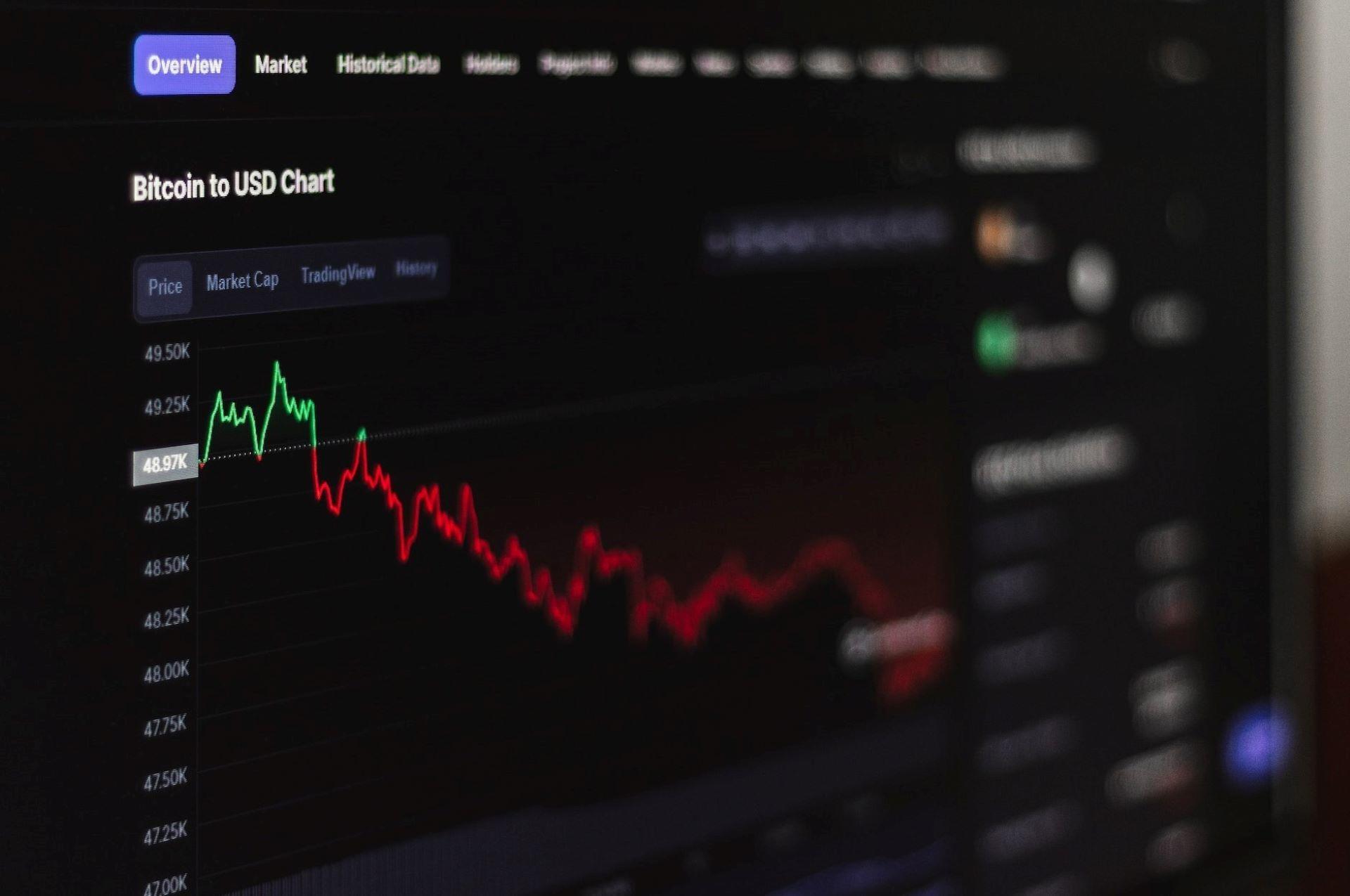

In 2022, cryptocurrencies were all over the news due to the massive crash that sent the values of many major cryptocurrencies tumbling.

Major cryptocurrencies like Bitcoin and Ether, for example, plummeted. For many, this was a sign that cryptocurrency couldn't be trusted, at least not yet, to be central to our economies.

The volatility of cryptocurrency is a major concern for many, but the overall trend for cryptocurrencies has been upward, despite headline-grabbing crashes. That said, after a crash, there are always opportunities to invest in the next big cryptocurrencies.

The positive sign for cryptocurrencies is potential regulation. Not the regulation itself as it remains to be seen whether that will be good or bad for cryptocurrencies, but rather the fact that governments and politicians on both sides of the political spectrum are paying attention to cryptocurrencies.

Volatility is currently part of the cryptocurrency landscape and something that most current investors are quite willing to accept as an inevitable part of investing, but to get more people using cryptocurrency, there needs to be some stability and many would see some form of regulation as a way to open the gate to crypto for more mainstream use.

With everything moving online, though, Bitcoin and other cryptocurrencies do seem like a natural progression in an increasingly digital world. It's all a bit of a Gold Rush at the moment and it's difficult to ascertain which cryptocurrencies are going to be the best investment due to their volatility and the sheer noise around it all, which is why it always pay to do your research and plan exit strategies before investing.

Relatively speaking, cryptocurrencies are quite new and the entire sector is a bit like the Wild West. There are going to be a lot of changes and there are a lot of powerful (and rich) people who are quite happy with economic systems the way they are and very likely to resist change.

For help investing in cryptocurrencies, consider looking for a financial advisor that specializes in crypto.

Summarize with AI: